What You Need to Know About Using a Contractor Answering Service as a Homeowner

As a homeowner, you know the importance of having reliable and trustworthy contractors to help maintain your property. But have you ever considered how much easier it would be if someone could answer all of your calls and schedule appointments for you? That’s where a contractor answering service comes in.

Below are details on why contractor answering service is becoming essential for homeowners everywhere, from increased efficiency to improved customer satisfaction.

Benefits for Homeowners

There are many benefits for homeowners who use a contractor answering service. One of the most important benefits is that it can help to save time. With a contractor answering service, all calls from potential customers will be answered by someone trained to handle them quickly and efficiently. This can free up a lot of time for the homeowner, who can then use that time to focus on other aspects of their business or their personal life.

Using a contractor answering service can help to improve customer satisfaction. Customers who can reach a live person when they call with a question or concern are more likely to be satisfied with the overall experience than those who have to leave a voicemail or wait for a callback. The service also helps to protect the homeowner’s privacy. By using an answering service, the homeowner’s personal phone number will not be made public, and they will not have to worry about potential customers calling at all hours of the day or night.

How the Service Works

Assuming you are a homeowner who needs work done on your home, you would contact the contractor answering service and explain the work that needs to be completed. The answering service would then take down all the relevant information and pass it along to one of their qualified contractors.

The contractor would then contact you to discuss the project, schedule a time to complete the work and provide a written estimate. Once all of that is agreed upon, the work would be completed at the scheduled time, and you would pay the contractor directly for their services.

Cost of Using a Contractor Answering Service

As a homeowner, one of the biggest expenses you must worry about is the cost of repairs and maintenance. Fixing it can be very expensive if something goes wrong with your home. This is a reason many homeowners choose to use a contractor answering service. Utilizing a contractor answering service can be a great way to save money on repairs and maintenance.

Conclusion

Homeowners can benefit greatly from using a contractor answering service. It provides an easy and cost-effective way to manage incoming calls, ensure that all inquiries are responded to promptly, and keep track of conversations with potential customers.

Moreover, the contractor answering service offers access to specialized customer support personnel who can help navigate the complexities of home repairs or projects. Ultimately, using a contractor answering service is invaluable for any homeowner looking for reliable customer support solutions without hiring extra staff in-house.…

Customer service can be a time-consuming task for small business owners. It can quickly become overwhelming, from answering emails to answering phone calls and managing customer complaints. You will have more time to focus on growing your business by outsourcing your customer service needs. A professional customer support team is an invaluable asset that will help you take care of your customers’ needs.

Customer service can be a time-consuming task for small business owners. It can quickly become overwhelming, from answering emails to answering phone calls and managing customer complaints. You will have more time to focus on growing your business by outsourcing your customer service needs. A professional customer support team is an invaluable asset that will help you take care of your customers’ needs.

A full-time human resources

A full-time human resources  Human resource managers can work with hiring managers to help recruit and hire staff. The manager can review the job description, determine what qualifications are required for each position, and actively seek prospects by advertising openings on social media sites like LinkedIn or Facebook, perhaps even reaching out to past employees who have left within the last year. The human resource manager may also provide insight into the most qualified applicants, saving the hiring manager time. HR managers can work closely with new hires during their first few months to ensure they learn all the job skills and feel comfortable enough for any upcoming performance reviews.

Human resource managers can work with hiring managers to help recruit and hire staff. The manager can review the job description, determine what qualifications are required for each position, and actively seek prospects by advertising openings on social media sites like LinkedIn or Facebook, perhaps even reaching out to past employees who have left within the last year. The human resource manager may also provide insight into the most qualified applicants, saving the hiring manager time. HR managers can work closely with new hires during their first few months to ensure they learn all the job skills and feel comfortable enough for any upcoming performance reviews.

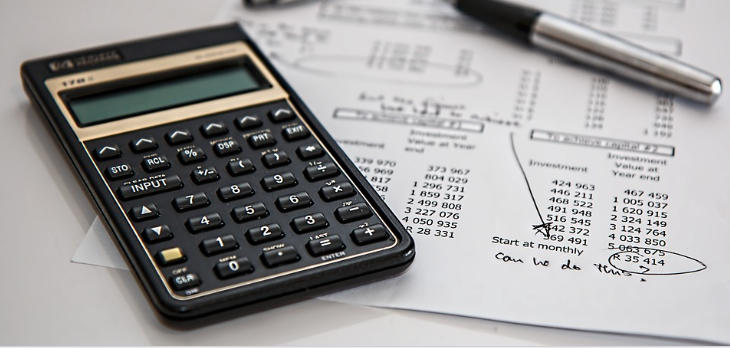

Credit cards are a widely accessible funding option for small businesses. There are even credit cards available specifically for businesses, though you will usually need to have a business license to acquire them. This can be a problem for those utilizing business opportunities that do not require licensing. In these situations, one may want to use a personal credit card. Personal credit cards can have limits almost as high as business credit cards, plus they can be used for other expenses.

Credit cards are a widely accessible funding option for small businesses. There are even credit cards available specifically for businesses, though you will usually need to have a business license to acquire them. This can be a problem for those utilizing business opportunities that do not require licensing. In these situations, one may want to use a personal credit card. Personal credit cards can have limits almost as high as business credit cards, plus they can be used for other expenses. Unlike business cash advances, home equity loans can be used for both small businesses and business opportunities. Best of all, home equity loans can offer huge amounts of money. It may not be as large as a business cash advance, but it is still more than enough to handle marketing expenses, especially if one is utilizing a free business opportunity. However, entrepreneurs will need to have good credit. If they don’t, they can consider looking into subprime refinancing mortgages, though these can be extremely hard to find.

Unlike business cash advances, home equity loans can be used for both small businesses and business opportunities. Best of all, home equity loans can offer huge amounts of money. It may not be as large as a business cash advance, but it is still more than enough to handle marketing expenses, especially if one is utilizing a free business opportunity. However, entrepreneurs will need to have good credit. If they don’t, they can consider looking into subprime refinancing mortgages, though these can be extremely hard to find.